Overview

Blueberry Markets is a global forex and CFD broker headquartered in Sydney, Australia. It offers 300+ instruments including currency pairs, shares, indices, and commodities. A $100 minimum deposit and copy trading tool make the broker popular with beginners, while the ultra-low latency VPS appeals to experienced traders.

Blueberry Markets was established in 2016, by owner Dean Hyde, a former Axi executive. The brand is also a registered business under the Eightcap umbrella.

Since its incorporation, Blueberry Markets has served over 30,000 clients and has established itself as a popular trading broker in the Australian financial market. With deep liquidity, ultra-fast execution speeds and zero-pip spreads, the broker provides a competitive trading environment for a range of strategies.

Blueberry Markets holds licenses with the Australian Securities and Investments Commission (ASIC) and the Securities Commission of the Bahamas (SCB).

Trading Platform

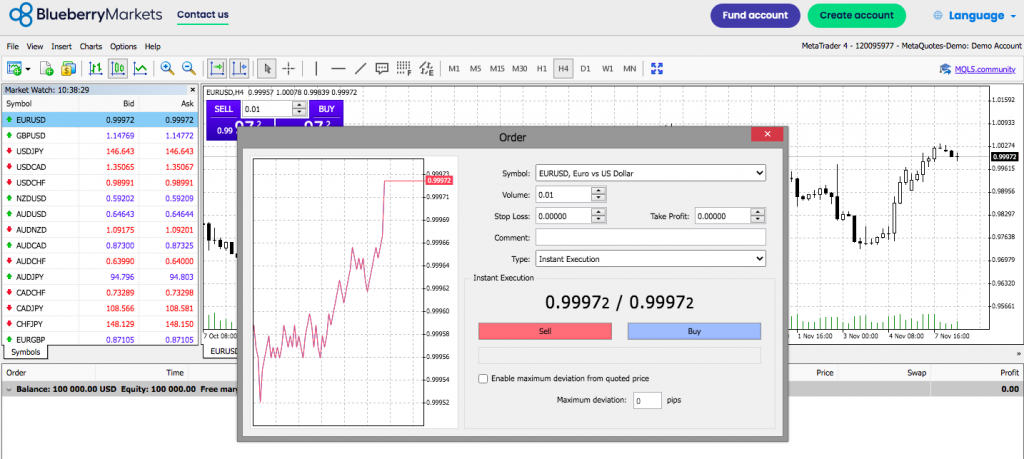

Blueberry Markets offers the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. The award-winning terminals will be familiar to experienced traders, providing a range of custom analysis tools, instant and pending orders, plus support for automated trading.

MT4 and MT5 are available for free download to Mac, Linux and Windows devices. Alternatively, there is a web-based terminal with no plug-ins required. Mobile-compatible apps are also available to download from the relevant app store.

MetaTrader 4

- VPS hosting

- Nine timeframes

- One-click trading

- Complete trading history

- 30 built-in technical indicators

- Customizable charts and drawing tools

- Four pending order types and trailing stops

- Direct access to Expert Advisors (EAs) or build your own trading bots

MetaTrader 5

- 21 timeframes

- 44 analytical objects

- One-click order execution

- Market search and grouping

- Thousands of trading plug-ins

- Integrated economic calendar

- 38 built-in technical indicators

- Automated trading capabilities

- Six pending order types and trailing stops

Account Types

There are two types of accounts with Blueberry Markets, and both are noted in the table a few sections below. One is a zero-commission account, where costs are built into the spread and the profit is yours to keep. The other is a raw spread account. There, a fixed commission is charged for each trade you make. The Standard and Direct Accounts, respectively, work well for traders who want traditional spread pricing or raw spreads/fixed commissions.

|

|

Standard

|

Direct |

|

Features |

Commission-Free, Great for Traders Who Prefer Spread Pricing |

Best-Suited to Traders Who Prefer Fixed Commissions and Raw Spreads |

|

Account Currencies |

USD |

USD |

|

Available Leverage |

1:500 (Maximum) |

1:500 (Maximum) |

|

Minimum Deposit |

$100 |

$100 |

|

Commission Per Trade |

$0 |

$7 |

|

Decimal Pricing |

Up to 5 |

Up to 5 |

|

Trading Instruments |

Forex, Indices, Commodities, Shares (US and AU), Crypto |

Forex, Indices, Commodities, Shares (US and AU), Crypto |

|

Min. Lot Size Per Trade |

0.01 |

0.01 |

|

Spreads |

1 |

0.0 |

|

Demo Account |

Yes |

Yes |

|

Swap/Rollover Free |

No |

No |

|

Copy Trading Support |

Yes (DupliTrade) |

Yes (DupliTrade) |

Fees

Blueberry Markets fees are based on a tight spread offering from 0.0 pips for professionals, also broker applies 0 commission on a standard account but charges a higher spread with service markup.

What is Swap Fee?

Also, always consider the overnight fee as a cost referred to as the Rollover rate, an interest for holding positions open overnight in Forex trading. It is determined by the overnight interest rate and is a differential between two involved in trade currencies.

- Blueberry Markets fees are ranked low with an overall rating of 8 out of 10 based on our testing and compared to over 500 other brokers. Fees might be different based on entity offering, see our findings of fees and pricing in the table below, however, Blueberry Markets’ overall fees are considered good.

| Fees | Blueberry Markets Fees | AvaTrade Fees | eToro Fees |

|---|---|---|---|

| Deposit Fee | No | No | No |

| Withdrawal Fee | No | No | No |

| Inactivity Fee | No | Yes | Yes |

| Fee ranking | Low | Average | High |

Spreads

Blueberry Markets Standard accounts with spread-only spreads are higher, due to costs that are inbuilt into the spread, so you will get around 1 pip for EUR USD, which is actually still considered a good proposal.

What is Blueberry Markets Commission?

If you trade with a professional account, there is a commission charge of $7, which is also may be lowered for high-volume traders and the spread is interbank offering typically 0.2 pips for EUR USD pair.

- Blueberry Market Spreads are ranked low with an overall rating of 8 out of 10 based on our testing comparison to other brokers. We found Forex spread much lower than the industry average of 1.2 pips for EURUSD, and spreads for other instruments are very attractive too

Comparison between Blueberry Markets fees and similar brokers

| Asset/ Pair | Blueberry Markets Spread | AvaTrade Spread | eToro Spread |

|---|---|---|---|

| EUR USD Spread | 1 pips | 1.3 pips | 3 pips |

| Crude Oil WTI Spread | 4 | 3 | 5 |

| Gold Spread | 30 | 40 | 45 |

Deposits and Withdrawals

The number of payment methods to fund the trading account will allow you to transfer funds quickly by the use of Visa/MasterCard, Skrill, POLi Payment, fasapay, and Bank Wire Transfers.

While you may choose a base account currency which will also assist in seamless transfer with no conversion fees.

- Blueberry Market Funding Methods we ranked Good with an overall rating of 8 out of 10. The minimum deposit is among average in the industry, yet fees are either none or very small also allowing to benefit from various account-based currencies, yet deposit options vary on each entity

Here are some good and negative points for Blueberry Markets funding methods:

| Blueberry Markets Advantage | Blueberry Markets Disadvantage |

|---|---|

| $100 is a first deposit amount | Methods and fees vary in each entity |

| Fast digital deposits, including Skrill, and Credit Cards | |

| No internal fees for deposits and withdrawals | |

| Withdrawal requests confirmed 1-3 business days |

Deposit Options

In terms of funding methods, Blueberry Markets offers numerous payment methods which are a very good plus, yet check according to its regulation whether the method is available or not.

Minimum Deposit

The minimum deposit amount requires $100 if you apply for a Standard account based on spread only. For professionals and accounts with tailored solutions, $2,000$ as the first deposit is considered a great opportunity for high-volume traders.

Blueberry Markets minimum deposit vs other brokers

| Blueberry Markets | Most Other Brokers | |

| Minimum Deposit | $100 | $500 |

Withdrawals

Blueberry Market does not charge any internal fees for deposits or withdrawals, and also includes a wide selection of payment methods. Yet, you should check with your payment provider in case any fees are waived due to international policies for money transfers, as some charges may be applicable, as well as regulatory requirements for Withdrawals to Bank Accounts only or so.

Leverage

One of the great features of Forex trading and a part of Blueberry Markets Review and check is an allowance to use leverage, which may increase your potential gains timely.

Leverage fall under regulatory restrictions being an Australian brokerage still allows high leverage ratios:

- Maximum leverage 1:30 for Forex instruments

- Leverage 1:500 for International resident clients

This all in all brings vast opportunities specifically for retail traders, as your trading size may magnificently enlarge. Nevertheless, always learn deeply about how to use maximum leverage smartly as “unhealthy” use may increase your risk dramatically and demands some higher margins as well.

Conclusion

Overall, our Blueberry Markets review concludes that this brokerage trading firm offers moderately good trading conditions for its clients. While Blueberry Markets may not be the best forex broker for active traders, you can still use their trading platform (MT4 or MT5) to trade throughout the day.

Blueberry Market FAQ’s

Do reviews by traders influence the Blueberry Markets rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about Blueberry Markets you need to go to the broker’s profile.

How to leave a review about Blueberry Markets on the Seven website?

To leave a review about Blueberry Markets, register on the main website or you can also leave a review through Facebook.

Is it possible to leave a comment about Blueberry Markets on a non-Traders Union client?

Anyone can leave feedback about Blueberry Markets on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.