XTB is a leading online CFD broker offering access to over 2,000 instruments via a powerful proprietary platform, xStation 5. Traders can speculate on forex, shares, indices, commodities, cryptocurrencies, and commodities. In this 2022 XTB review, we unpack the broker’s trading spreads, demo account services, mobile apps, customer support, and more. Find out whether to register for a live trading account today.

Company Details

Established in 2002, XTB is one of the largest stock-exchange listed brokers with a presence in 13 countries, including the UK, Poland, Germany, and France, to name a few. Over 495,000 accounts have been opened in the last two decades. XTB provides retail traders with instant access to hundreds of global markets.

Known for its transparency and speed of execution, both XTB and its analysis team have won a number of prestigious awards for its services and research – including the #1 EMEA Bloomberg spot for FX accuracy in Q2 of 2020 and Q3 of 2018.

The company is also regulated by several leading watchdogs, including the Cyprus Securities & Exchange Commission (CySEC) plus the UK Financial Conduct Authority (FCA).

Trading Platform

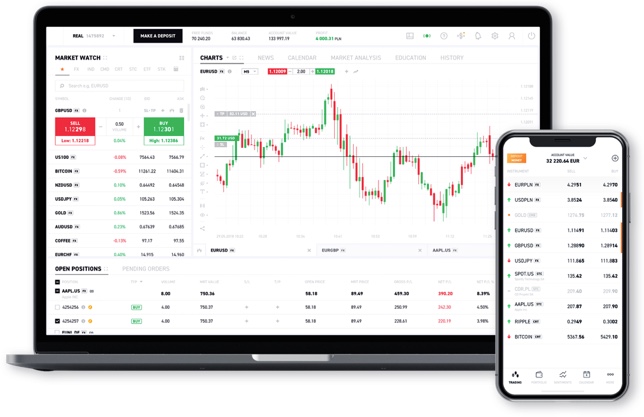

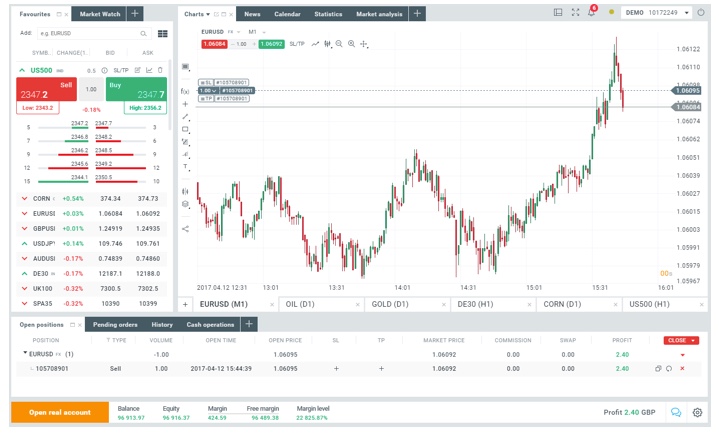

XTB’s proprietary trading platform, xStation 5, is impressive.

xStation 5 was voted ‘Best Trading Platform 2016’ by the Online Personal Wealth Awards and offers reliable, instant execution (at an average of 85 milliseconds) with no requotes.

It features a free market audio commentary – a paid service with other brokers – as well as an advanced trading calculator which instantly determines every aspect of your trade for you.

It also has a comprehensive video tutorial section, a stocks screener, sentiment heatmaps and real-time performance stats that break down your trading behavior, showing you where your strengths and weaknesses as a trader lie.

xStation 5 is available on desktop, tablet, mobile, and even your smartwatch, and has a variety of innovative technical tools to help with your trading. Importantly, the platform is also suitable for all experience levels.

Web Trader

The Web Trade platform allows traders to use xStation 5 through the web, without having to download extensive software and works with Chrome, Firefox, Safari and Opera. The platform is also compatible with a range of devices including Windows and Mac.

Note that since 2022, XTB traders are no longer able to open accounts on the MT4 platform.

Assets & Markets

XTB offers over 2,100 instruments, spanning six categories:

- Forex: 57 currency pairs. These include all major currency pairs, plus some minors and exotics

- Shares: XTB offers CFD trading in more than 1,500 shares of companies that trade in the United States, United Kingdom, Poland, Portugal, Spain, Switzerland, France and Finland

- Indices: The platform offers over 20 indices from all over the world, including US, Germany and China

- ETFs: Traders can speculate on 1,850 global stock CFDs with no trading limits

- Commodities: Trade popular commodities including gold, silver, oil, wheat, copper, coffee, aluminium, nickle and platinum.

- Cryptocurrencies: The biggest names in crypto such as Bitcoin (BTC), Litecoin (LTC), Ripple (XRP), and Ethereum (ETH). Not available to UK traders

Our experts were disappointed to see that the online brokerage does not offer futures or options trading.

Spreads & Fees

Generally, XTB offers competitive rates to all clients.

In Feb 2022, XTB introduced 0% commission trading for Standard account holders. Fees were built into the spread.

Trades placed with a Pro account are subject to a commission charge. This will vary according to the base currency.

Margin trades may be subject to an overnight swap charge based on overall exposure.

Accounts are free to set up and there are no minimum deposit requirements.

A 0.5% currency conversion fee will be charged on all trades on instruments denominated in a currency that differs from the currency of the account.

XTB Account Types

XTB offers a Basic, Standard and Pro account.

An XTB Standard account is free to set up. Spreads start at 0.35 pips, the minimum order size is 0.1 lots and leverage is capped at 1:30. Trading via the Basic and Standard accounts is commission-free and automated trading is supported. An Islamic account is also available upon request.

Account options do vary by country so check the official site to see what is available in your location.

Registration Process

Traders can apply for a live account using a simple online form.

As with all regulated brokers, XTB must go through the due process of ‘KYC’ (know your customer) and protection against money laundering activity in checks that are designed to make things more secure for traders.

On the website, you will see the green ‘Create Account‘ button. Clients will be asked to enter their personal details such as name, phone number, and national insurance number.

Then, you can select the trading platform, account type (Basic, Standard or Pro), language and currency.

The last stage is to verify your ID. Proof of address and identity can be verified using any of the following:

- Passport

- Driver’s license

- Identity card

Traders can also upload a copy of their ID proof from their phone. The copy should be clean, and up to date.

Once complete, clients can login and start trading.

Mobile App

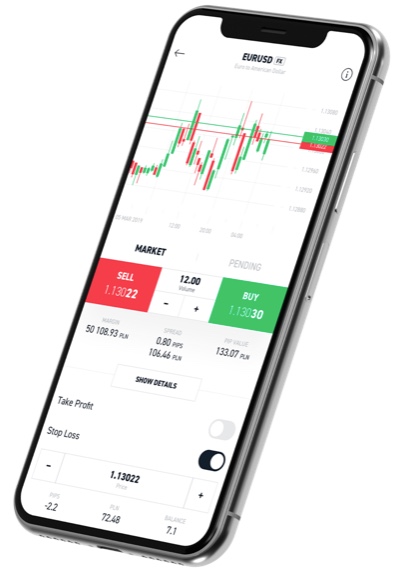

XTB’s mobile app allows traders to execute orders directly from their mobile device.

Clients can access over 1,500 global financial markets via a fully optimized mobile platform. Mobile trading also supports account management features as well as charts and other key tools required for real-time trading.

Android, Windows and iOS devices are supported as well as tablet devices. Simply download the XTB mobile app from the relevant application store.

Deposits

XTB broker accepts credit/debit cards (Visa, Mastercard, Maestro), e-wallets like Skrill and Paysafe, plus wire transfers (though only in the country where the account is registered). Most payments are processed instantly.

XTB does not charges any deposit fees, except for with Paysafe which comes with a 2% charge. Clients may also have to pay exchange rate charges if transferring in a currency different to the account’s base currency.

The following currencies are accepted: EUR, USD, GBP, and HUF.

Withdrawals

Withdrawals are processed the same day if the request is made before 1 pm GMT. If the request is made after 1 pm, it is processed on the next business day. This applies to GBP, EUR, and domestic HUF withdrawals.

Withdrawals go to your nominated bank account, which you will need to provide documentation for.

Most withdrawals are free of charge. However, small sums may be subject to a charge. For a full list of charges, visit the official website.

XTB Leverage

The leverage available to clients will depend on location and local regulation.

UK residents are onboarded to XTB Limited UK. As an FCA-regulated entity, the maximum leverage available is 1:30.

For EU residents, under CySEC regulation, leverage is also available up to 1:30 whilst non-EU residents have more flexibility. Leverage is available up to 1:500.

Demo Account

XTB offers a free demo account.

The account is available to use for four weeks and is credited with 100k in virtual funds. Clients have access to 2,100+ CFD markets including forex, indices, commodities, and shares.

Support is available 24-hours (Sunday to Friday).

Regulation & Reputation

In terms of regulatory oversight, XTB subsidiaries are overseen by several financial agencies:

- XTB UK is regulated by the Financial Conduct Authority under license number 522157

- XTB Europe is regulated by CySEC under license number 169/12

- XTB International is regulated by the Belize International Financial Services Commission under license number IFSC/60/413/TS/19

- X-Trade Brokers DM SA is authorized by the Polish Securities and Exchange Commission under license number DDM-M-4021-57-1/2005 and supervised by the Polish Financial Supervision Authority (Komisja Nadzoru Finansowego)

- XTB Spain is regulated by the Comisión Nacional del Mercado de Valores under license number 40

- XTB MENA holds a category 3A license from the Dubai Financial Services Authority (DFSA)

As per company rules, client funds are held in separate accounts from the company’s funds. Traders’ funds are protected up to 85,000 GBP through the financial services compensation scheme (FSCS), in case of insolvency.

Education Resources

XTB provides a range of tailored educational materials to clients, many of which are free of charge.

Our experts found training videos, online articles as well as tools for live webinars. There is also a free trading library download, ideal for beginners.

In addition, there is a ‘Trading Academy’. The online academy is divided into four categories: Basic, Intermediate, Expert and Premium. The topics of fundamental and technical analysis are covered in the intermediate section.

Furthermore, XTB has teamed up with football legend, José Mourinho, to share tips on approaching financial markets and handling stress.

Trading Alerts

Clients can opt in to receive mobile trade alerts from an industry expert. The service is available free of charge for seven days after which a fee is incurred.

Alerts are shared in real-time via WhatsApp and include breaking news and updates on key technical levels.

XTB also runs regular Trading Clubs in its headquarters in Canary Wharf, London. This is a great opportunity to meet other traders face to face. These clubs include open discussion on a variety of strategies and live market analysis.

Customer Support

An experienced customer service team works 24 hours a day, 5 days a week, and is available via phone, email and live chat. Additionally, clients are assigned an account manager to assist with account-related matters.

Support is available in the following languages:

- English

- Czech

- French

- German

- Hungarian

- Italian

- Portuguese

- Polish

- Russian

- Romanian

- Spanish

- Slovak

- Turkish

- Vietnamese

- Thai

- Arabic

Note, XTB is not permitted to operate in the United States due to local regulations.

Benefits

While using XTB, our experts found the online broker had a lot to offer traders:

- Global presence

- Cashback rebates

- Free demo account

- 2,100+ instruments

- Mobile trade alerts

- Micro lot trading

- Spreads from 0.1 pips

- Flexible account options

- Professional investing account

- 1:500 leverage for global traders

- No minimum deposit requirements

- A suite of useful educational resources

- FCA, KNF, CySEC, and IFSC-regulated

- 24 hour customer support available Sunday to Friday

- Award-winning; “Best forex broker Award”, “Best trading platform”, “Online personal wealth”

Drawbacks

However, there are also some limitations to opening a live XTB account:

- Single platform offering

- Not available to US clients

- Instrument portfolio limited to mostly CFDs

Safety & Security

XTB has a number of measures in place to ensure the safety of client funds:

- Access authorization – access is enabled via password, fingerprint, or code only

- Encrypted connections – all connections between XTB services and mobile apps are fully encrypted

- Multi-factor authentication – key changes can only be implemented once identity has been verified via multiple methods

- Advanced network infrastructure – XTB is consistently working to improve its infrastructure, adopting new technologies to guarantee client safety and security

It is also regulated by some of the world’s leading bodies, ensuring that the broker adheres to a high standard of operation.

Verdict

XTB is an established, well-regulated broker offering access to a good range of global markets and instruments. The proprietary trading platform, xStation, is an award-winning terminal. Account options are flexible and spreads are generally competitive.

If you are a trader based in the UK or EU, in particular, XTB could be a good choice. Note, that services are not available to US clients.

Accepted Countries

XTB accepts traders from Thailand, United Kingdom, South Africa, Hong Kong, France, Germany, Norway, Sweden, Italy, Denmark, United Arab Emirates, Saudi Arabia, Kuwait, Luxembourg, Qatar and most other countries.

Traders can not use XTB from United States, Canada, Australia, Japan, Slovakia, Singapore, Mauritius, Israel, Turkey, India, Pakistan, Bosnia And Herzegovina, Ethiopia, Uganda, Cuba, Syria, Iraq, Iran, Kenya, Romania.